New BFPA Consultative Panel formed to advise on Brexit negotiations

03 Oct 2018

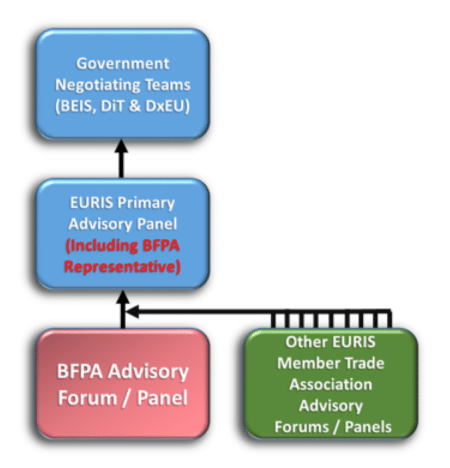

As part of BFPA’s recent lobbying efforts, Chris Buxton, BFPA’s CEO has been involved with EURIS which has been gaining influence on all issues relating to Brexit amongst the Government departments of BEIS, DIT and DxEU. The latest development is the formation of a consultative panel made up of representatives from each of the EURIS member associations of which BFPA is, of-course, a leading advocate. Behind this panel is an additional advisory panel from each trade association including BFPA. The sub-groups as they have been called, provide their ‘Chair’ with a common view on key issues raised by Government and the ‘Chair’ then attends the Primary panel and therefore represents their specific sector.

Volunteers from the BFPA membership have formed a sub-group comprising representatives from the following companies:

Argo-Hytos Ltd

Argo-Hytos Ltd

Asco Numatics

Aventics Ltd

Bachy Soletanche Ltd

BHR Group

Bosch Rexroth Ltd

HydraForce Hydraulics Ltd

Hydroscand Ltd

Kawasaki Precision Machinery UK Ltd

Linde Hydraulics Ltd

MP Filtri UK Ltd

National Oilwell Varco Training Centre

Pirtek UK Ltd (Acton)

Teichmeister Ltd

Yuken Europe Ltd

Steve Cardew from Kawasaki Precision Machinery UK Ltd has stepped up to the role of Chairman of the BFPA group. He attended the first face to face primary panel meeting with BEIS on Tuesday the 18 September. To date, members of the panel have been giving direct input into the Brexit discussions which EURIS are having with BIS and government. This will now gather momentum as the 31 March 2019 fast approaches.

Following consultation with trade association members and the various consultative panels, EURIS has also produced a document called Securing a competitive UK manufacturing industry post Brexit to download a copy click here.

In connection with the latest EURIS consultations the following press statement was released on 11.9.18:

Four out of five manufacturers in industrial product supply sector want continued regulatory alignment with the EU after Brexit

An overwhelming majority of UK industrial product manufacturers want continued regulatory alignment with the EU, a new industry survey has revealed.

Responding to a survey by the advisory body EURIS and independent experts at The UK Trade Policy Observatory (UKTPO), 83% of industrial product manufacturers support continued regulatory alignment in order to remain competitive in a global market with respondents overwhelmingly saying they see no benefit in moving away from the EU regulatory system for industrial and manufactured products.

UK companies told the survey that their supply chains have already been disrupted by post-referendum currency changes and that EU27 companies have started to select non-UK suppliers amidst the ongoing uncertainty of post-Brexit arrangements.

Industrial manufacturing representatives are calling for a Withdrawal Agreement to be reached with the European Commission at the earliest opportunity to give clarity to industry; they warn that a no-deal Brexit will cause severe damage and must be avoided.

The survey results are published today in ‘Securing a competitive UK manufacturing industry post Brexit’, a report on the impact of a no-deal Brexit on the industrial product supply sector by the University of Sussex-based UKTPO and EURIS, which represents companies with a collective turnover of £148 billion and with 1.1 million employees. EURIS notes that the negotiations on the future relationship between the UK and the EU27 are the most important for its members since the formation of the single market in 1993. The advisory body warns a ‘no deal’ outcome would have lasting impacts on the industrial product supply sector, and its ability to contribute to the UK economy. This report provides specific information and guidance on the significant dangers of the ‘no deal’, and the opportunities that a ‘business friendly’ deal will bring.

Key findings in the report include:

• EU Regulation enables industry to remain competitive in a global market. 83% of survey respondents support continued regulatory alignment with the EU. Product regulation has a critical role in ensuring that a high standard of safe and compliant goods are placed on the EU market. There is no benefit in moving away from the EU regulatory system for industrial and manufactured products.

• Imports account for over half of total costs for 44% of companies. Any increase in barriers to trade will have significant impact on the UK’s global competitiveness. Our competitive advantage in non-EU markets depends on the UK having barrier free-trade for intermediary products and components with the EU. Notably, 52% of EURIS survey respondents stated that over half their sales were intermediate inputs for other companies.

• The longer the uncertainty over the Brexit process continues, the more long-lasting damage will be incurred by our businesses. EU 27-member states have been warned to ‘prepare for the worst’ and review their supply chains. For most companies changing suppliers is a significant decision, and one very rarely reversed and some EU27 companies have already started to select non-UK suppliers. One third of EURIS survey respondents are already thinking about or have already changed suppliers due to Brexit – sales have already been lost.

• It is not a choice of exporting to Europe or the rest of the world. If we become less competitive in the EU we will be less competitive in other international markets. The UK Government’s target to develop stronger trading relationships with other non-EU countries is a positive move, but this can only be achieved if we maintain a strong alignment with EU regulations and supply chains.

Other key conclusions from the survey include:

• Four in ten companies say they will face a skills shortage without EU workers.

• 15% of firms believe even a two hour delay at customs would impose additional costs on their business

• Just 4% of respondents had no concerns about any element of Brexit impacting their business.

• Approximately 1/3 of respondents have already seen a fall in investment due to Brexit with only 2% reporting an increase.

Dr Howard Porter, EURIS Chair said: “Our industry needs clarity and a Withdrawal Agreement confirmed with the European Commission in the Autumn. As this report and our member survey clearly show, further delays and the risk of no-deal will result in significant long-term damage to the UK manufacturing sector and will put at risk the industrial product supply sector’s £148 billion contribution to the UK economy.”

Professor L Alan Winters, Director of the UK Trade Policy Observatory said: “The challenges of a ‘no deal’ Brexit have been much discussed, including by the UKTPO, but this survey brings them to life. This critical sector is already starting to hurt and if its needs for frictionless trade with the European Union are ignored, a quarter of UK goods trade will be vulnerable to cuts. The threat to jobs is alarming.”

Mike Hughes, Zone President Schneider Electric UK & Ireland: said “EURIS’ report ‘Securing a competitive UK manufacturing industry post Brexit’, highlights that the UK will always be closely tied to the EU as our primary trading partner. Our potential to develop trade links with non-EU countries is dependent on accepting this. As an industry, we believe it is essential that the UK maintains strong regulatory alignment for our sector with the EU, and continued membership and involvement in the creation of EU and International standards for the industry.” (Schneider Electric are a member of BEAMA who are a member of EURIS).

Please contact BFPA if you would like more information on our lobbying work.